How to get legal help this tax season

There are so many tax time-related acronyms that it can be tough to keep track of everything. Whether you’re looking for free tax help or legal assistance to deal with the IRS, here are two resources you may find useful: VITA sites can help you file your taxes, while LITCs can help you with legal representation when resolving tax disputes (ex: audits or large balances due) with the IRS.

Need help filing your taxes? Check out Volunteer Income Tax Assistance (VITA) sites

- If you make under $57,000 a year, you could visit a VITA site (or schedule a time to work with a tax preparer online) to have your taxes completed for free. VITA sites are staffed with trained volunteers who help with basic tax preparation.

- Trained volunteers can also help you determine your eligibility for special tax credits such as the earned income tax credit (EITC), child tax credit (CTC), and credit for the elderly or the disabled.

- BONUS: Since the pandemic started, many VITA sites have adapted to helping people over the phone as well as over video meetings. So you may not have to travel far to get help in filing your taxes.

Already filed your taxes? Check out Low-Income Taxpayer Clinics (LITCs)

- If you need assistance resolving a tax dispute with the IRS and cannot afford legal representation, you may qualify for help from an LITC.

- People go to LITCs when they’re dealing with: audits, appeals, collection matters, responding to IRS notices, correcting tax account problems, and federal tax litigation

- Experts who work at LITCs could assist you with: (1) Determining the merits of your case, (2) responding to the IRS audit on your behalf, and (3) counseling you on your options and the next steps in the process.

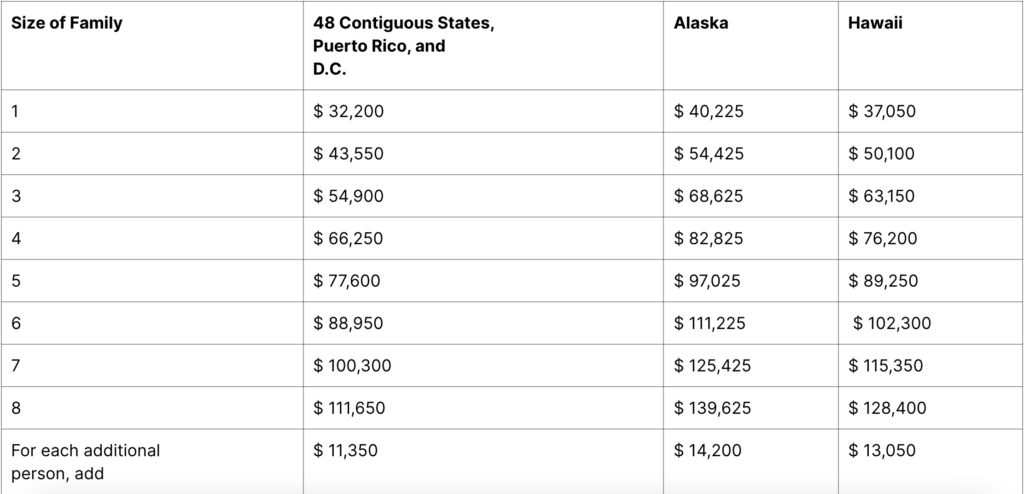

- LITCs provide free legal representation through full-time tax attorneys or CPA experts on tax law for people whose income is below a certain threshold.