Relying on Credit Cards to Get Through the COVID-19 Pandemic

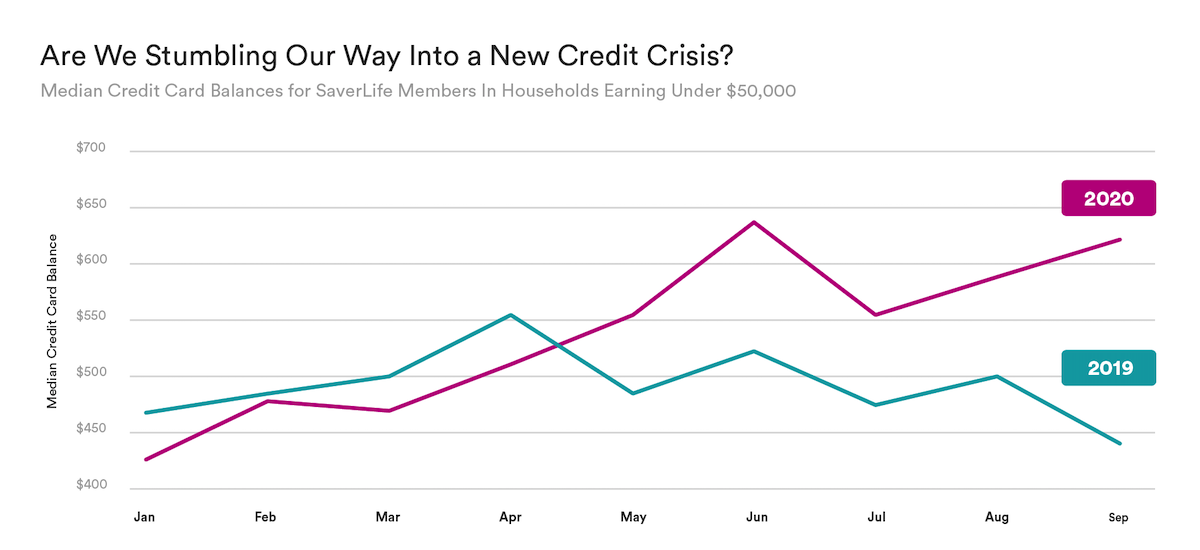

In 2020, SaverLife members have been withdrawing money from their savings more often than they did in 2019. And compared to last year, people are relying more on credit cards to feed their families. For people living in households earning less than $50,000 a year, credit card balances have increased by 38% from last year.

During these difficult times, Equifax, Experian, and TransUnion are offering FREE weekly credit reports until April 2021. And if you’re wondering how to create a family-friendly budget during the COVID-19 pandemic, SaverLife CFP Tania Brown has some tips just for you.

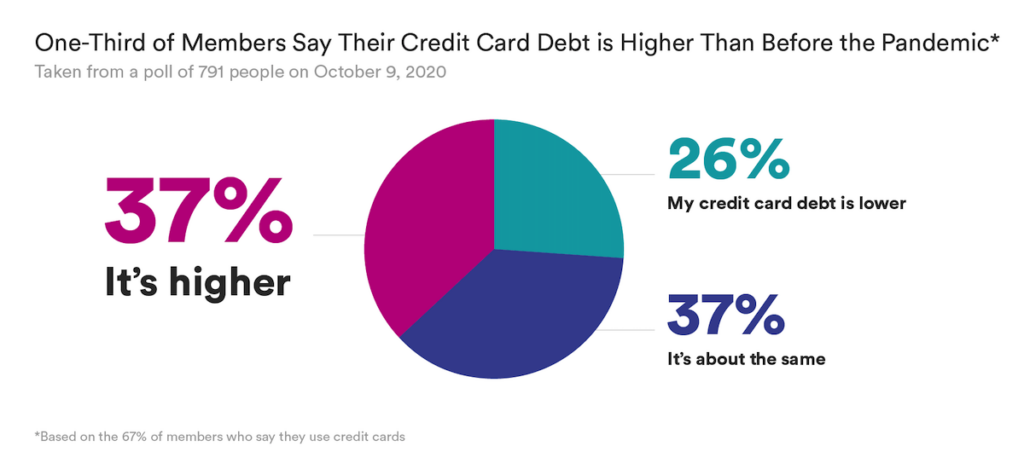

Credit card debt

A third of SaverLife members are also reporting an increase in credit card balances. If you’re struggling to save money while you’re in debt, here’s how to start an emergency fund.

“I’m also on the Food Share Program, which has helped a bit. At this point, everything is month to month, and I pay down whatever I can come up with. On top of all that, I can’t afford to pay my credit cards off. I have three liens against me. It costs $2,500 to file for bankruptcy, and I can’t even afford to do that.” –Michelle, SaverLife member