Week 1 Stash Cash Quiz Results

Here are the results from our first holiday savings quiz! Scroll through to see what members answered and take the quiz yourself.

1. I regularly save for things like travel, cars, and gifts.

It’s essential to save for future expenses like travel, cars, and gifts, so you don’t go into debt or miss a bill in order to cover the cost. Make sure you are including short-term expenses in your budget!

2. I set aside money for emergencies monthly.

Saving is about consistency, not the dollar amount. Saving $5 a week is better than not saving at all. If you struggle to save, use the guidance in this article, 3 Reasons to Set Up an Automatic Plan, to start saving. Saving is about consistency, not the dollar amount. Saving $5 a week is better than not saving at all.

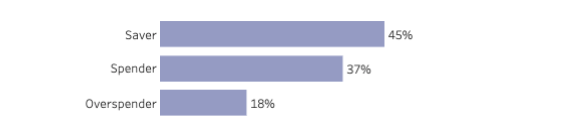

3. Which of these best describes how you see yourself?

Being self-aware of your spending habits helps you identify and develop ways to control your spending. For instance, if you overspend on eating out or shopping, you may decide only to use cash or wait for 24 hours before buying anything.

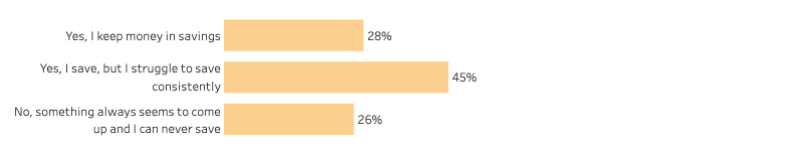

4. Are you able to save?

Your mindset about saving can affect your ability to save. Even if you can only save $5 a week, it’s still a savings win!

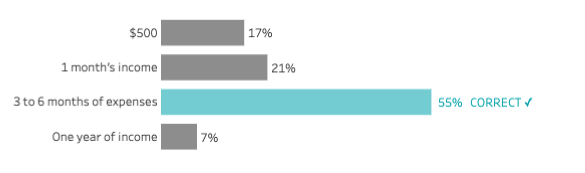

5. What’s a rule of thumb for how much to save for emergencies?

A rule of thumb from most financial professionals is to save 3 to 6 months of expenses. This amount helps you cover a few months of job loss or major expenses like needing a new car transmission.

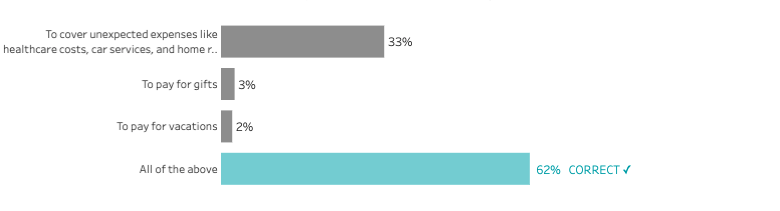

6. What’s a good reason to save money?

Prevent the financial “sticker shock” of having to pay for short-term expenses by saving a small amount monthly to cover the cost. For instance, if you have a $200 budget for expenses, save $50 a month for four months.

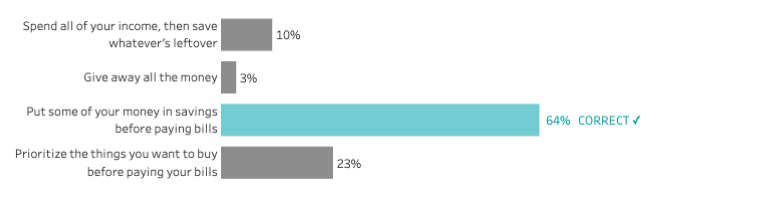

7. What does “pay yourself first” mean?

“Paying yourself first” is all about prioritizing saving to cover the unexpected before spending money on other expenses. It’s shifting how you manage your money to a “savings mentality.” This means when you get paid, save part of your paycheck and decide how to spend the rest.