Week 2 Budgeting Quiz Results

Here are the results from our second holiday savings quiz! Scroll through to see what members answered and take the quiz yourself.

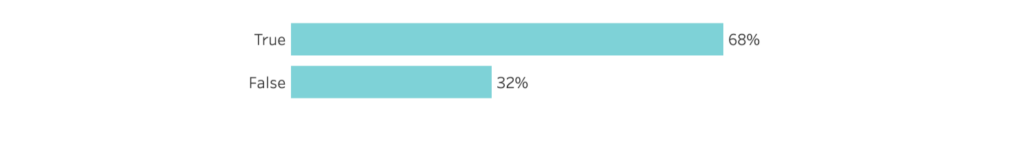

1. I use a budget to manage my spending monthly.

A budget is your plan for how you will spend your money. A budget can also help you plan for how much money to save monthly to help you reach your savings goals. There are plenty of budgeting apps to help you budget. Read What apps do you recommend to track your spending habits? for suggestions on choosing a good budgeting tool that works for you.

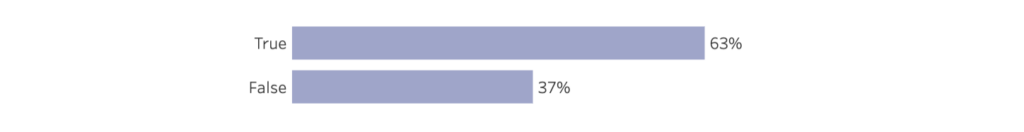

2. Before I buy something, I carefully consider whether I can afford it.

We all have busy lives. A budget reminds us of upcoming expenses so we don’t overspend.

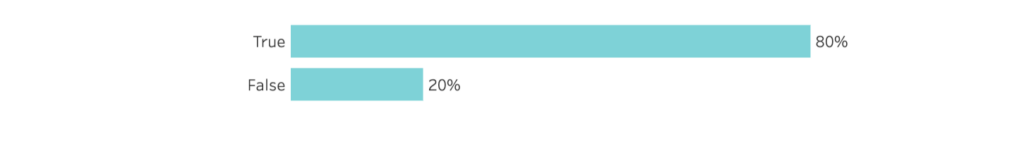

3. I feel like my spending is under control.

If you feel that your spending is out of control, consider creating a budget. A budget is far more than a set of numbers on a spreadsheet. A budget helps to give you boundaries to keep your spending under control. For instance, if you struggle with clothing, giving yourself a certain amount to spend on clothing gives you limits on your spending.

4. I know how to create a budget.

If you know how to create a budget, great! Every quarter, do a review to make sure that your budget truly accounts for your spending. If you struggle to create a budget, read 6 Steps To Creating the Perfect Budget. This article walks you through a step-by-step process for creating a budget.

5. It’s hard to stick to my budget when unexpected expenses arise.

If you are struggling to budget for unexpected expenses, review your budget to make sure you are accounting for all expenses, not just bills. Also make sure that your budget is realistic. If you have a family of 6, a $100 grocery budget may not be realistic. For more tips to help you stick to your budget, consider reading 5 Reasons Why You Can’t Stick to A Budget and How to Fix It.

6. What types of expenses should be in your budget?

A budget should cover more than you bills. It should account for all spending like school activity fees or holiday spending.

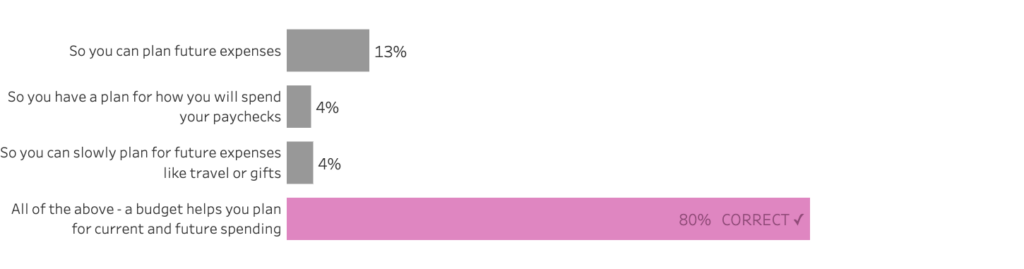

7. Why is it important to budget?

Budgeting helps you stay current with monthly expenses and plan for future expenses so you don’t go into financial shock over upcoming expenses.

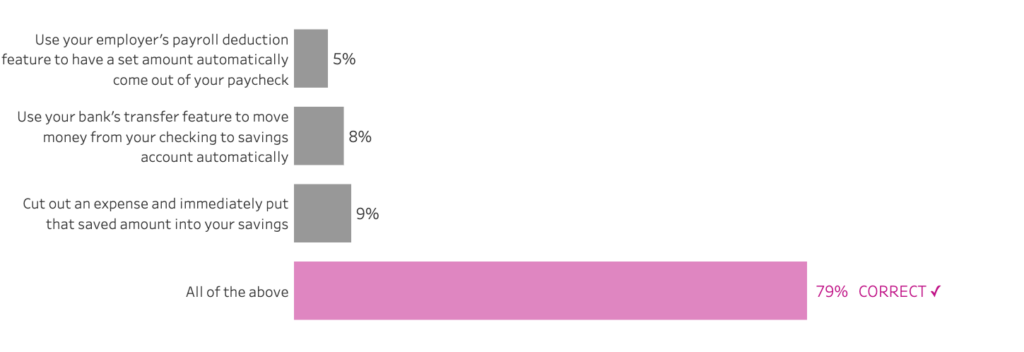

8. What are some ways to help you save more money?

The best way to save money is whatever method keeps you consistent. If you’re worried about being disciplined enough to save, or busy, then consider doing automatic deductions from your paycheck or bank account. Train yourself to transfer to have a savings mindset by committing any extra money—whether it’s from cutting back on an expense or a tax return to savings.