Latest SaverLife Research: How Work, School, and Parenting Are Impacting Low-Income Parents

Parents of remote-schooled children are earning less money and facing increased expenses while being forced to make impossible choices between work and family.

Low-income families were battling poverty and inequality, and the COVID-19 pandemic has only made things worse. Now is the time to start redesigning the way we systematically address opportunity and mobility in our society and culture.

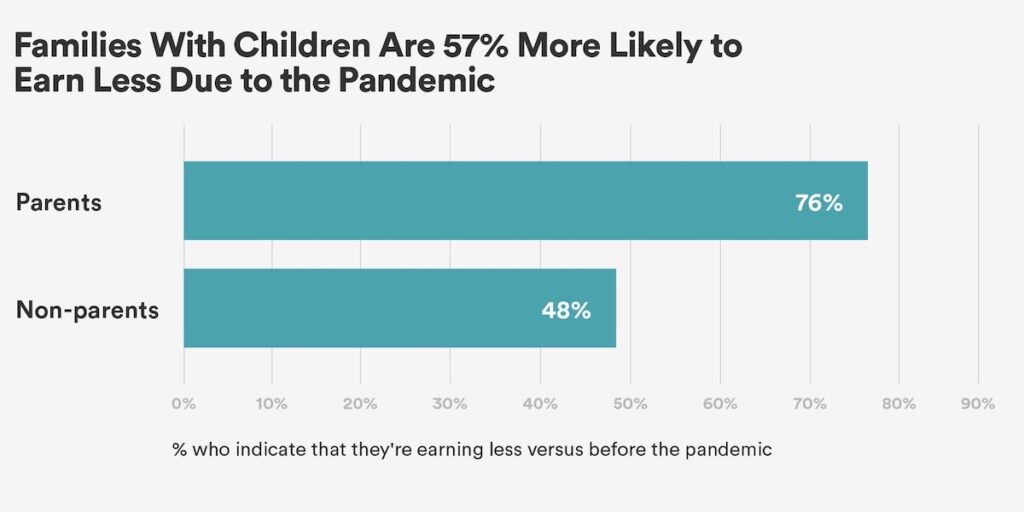

Families with children are earning less

Households with dependent children have been impacted much more than households without children. 76% of parents report earning less money now compared to pre-pandemic. This is a 57% increase vs. non-parents.

68% of parents say their children aren’t attending school in-person. This makes it increasingly difficult to earn income.

As of January, half of all American children are still learning virtually, and even schools that are “open” are often not operating 100%. Most schools have adapted by using smaller cohorts and shorter schedules to adhere to public health guidelines. School children have been learning from home for about a year, which has put a financial strain on parents.

The parents of children who have been remote-learning are 35% more likely to say they have a difficult time earning money than parents whose children are attending school in-person.

- Need help finding FREE or reduced-cost internet services? Here’s a list of resources.

Remote schooling means higher costs

Parents with remote-schooled children are 46% more likely to say their expenses have increased during the pandemic compared to non-parents. Those same parents with remote-schooled children are 19% more likely to say their expenses have increased compared to parents whose children are learning in-person.

These results are even more striking for people of color, as 82% of non-white members with children indicate that their expenses have increased during the pandemic (vs. 72% for white members).

Here are additional resources:

- SNAP COVID-19 waivers – these are for people who would typically not qualify but do because of the pandemic

- The USDA School Finder can help you find meals for your kids when schools are closed

What’s driving up expenses?

Compared to non-parents, parents with remote-schooled children are 53% more likely to say food costs drive up expenses. And compared to parents whose children are attending school in-person, parents with remote-schooled children are 15% more likely to say food costs drive up expenses. Government assistance has not been enough to cover the increased costs.

- The FullCart website can help you find emergency food resources near you

- Locate your local Feeding America foodbank using this tool

Childcare costs have also impacted parents. Pre-pandemic, many members relied on extended family for help with childcare costs, but for the past year, 69% said they weren’t able to depend on their typical support network. Additionally, without the care and support provided by open schools, parents of remote-schooled children are having to cover increased costs for childcare and school supplies.

How the American Rescue Plan helps fix these issues

Below is a breakdown of the American Rescue Plan, also known as the third stimulus, signed into law last week by President Biden. From increased tax credits to extended unemployment insurance, there’s much more to the latest bill than just the stimulus check.

Check out this article if you’d like to learn more about the third stimulus bill.

- Haven’t received your 3rd stimulus check? Use the Get My Payment tool from the IRS to see when your payment will be sent