SaverLife members tell it like it is…

SaverLife members have been weighing in on how they feel about saving, budgeting, debt, and spending. Here are their responses:

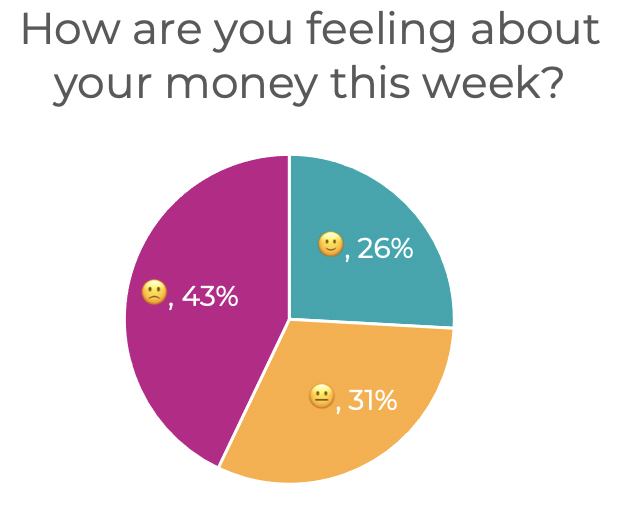

How SaverLife members feel about their money overall.

If you’re not feeling that great about your money, here are some resources just for you:

- Three Calming Strategies for Managing Money Anxiety

- How to talk about finances with your children

- 8 Tips for Financial Planning During an Economic Downturn

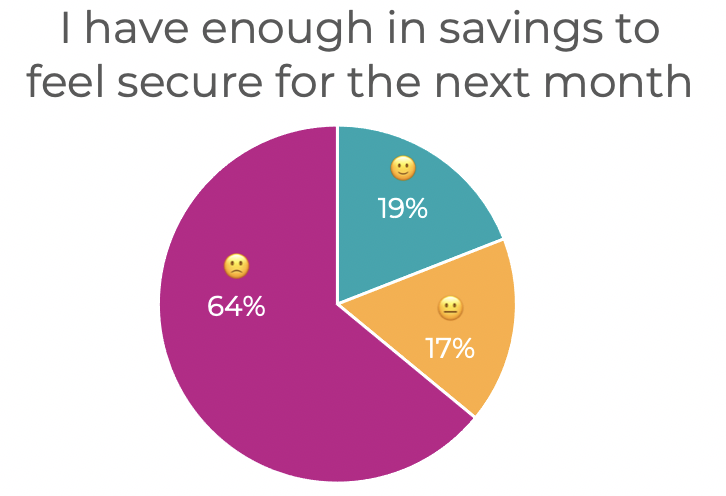

How SaverLife members feel about their ability to save.

Here are a few tips to help you keep on saving:

- How can I save on a fixed income and disability?

- What is a Sinking Fund?

- Everything You Need to Know About High-Yield Savings Accounts

- How much of my income should I save?

- What Is a Recession and How Do I Prepare for One?

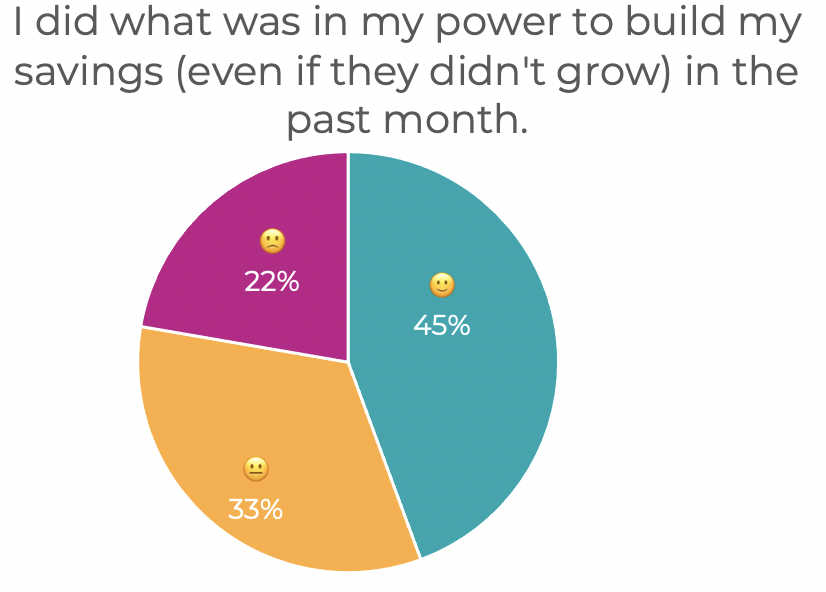

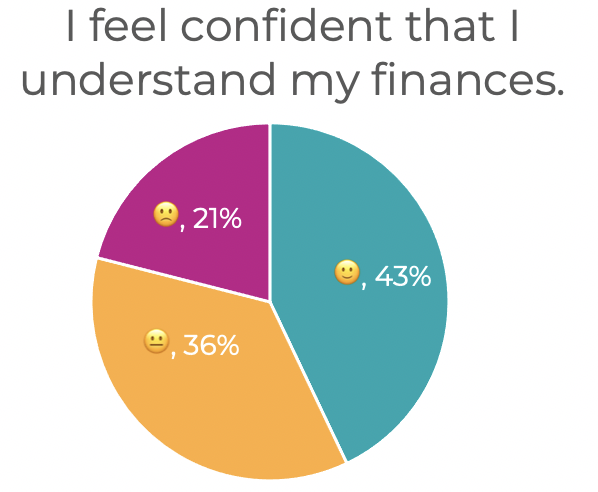

How SaverLife Members feel about their budgeting.

Budgeting, just like saving, can be especially tough when you have a fixed income. Here are a few resources to help you budget even better:

- How to Break the Paycheck-to-Paycheck Cycle

- How Distinguishing Between Needs and Wants Can Help You Build a Better Budget

- What should I do to budget if I’m on unemployment?

- How to Make a Budget for Your Family During COVID-19

- A Side Hustle Can Fix Your Budget

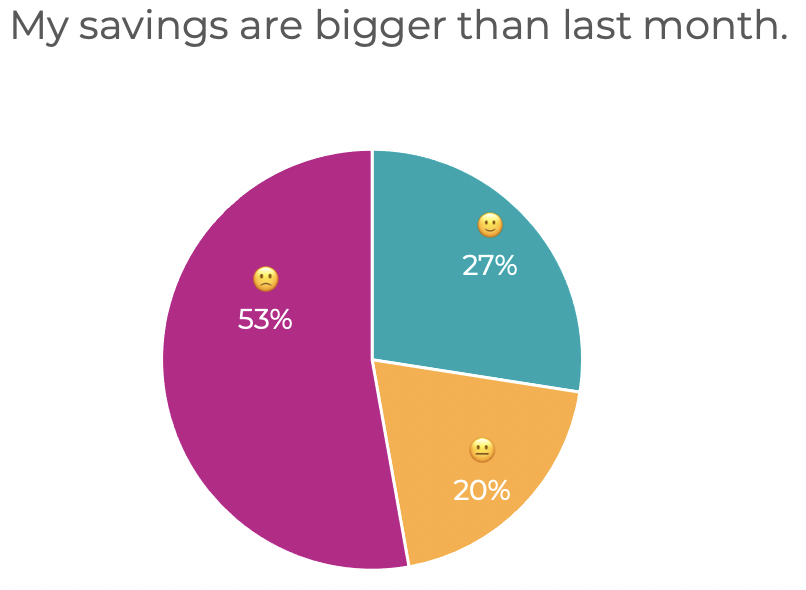

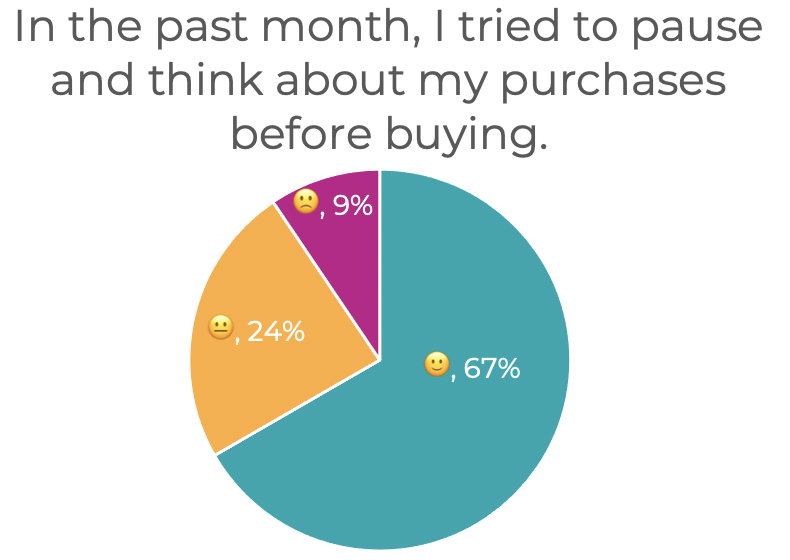

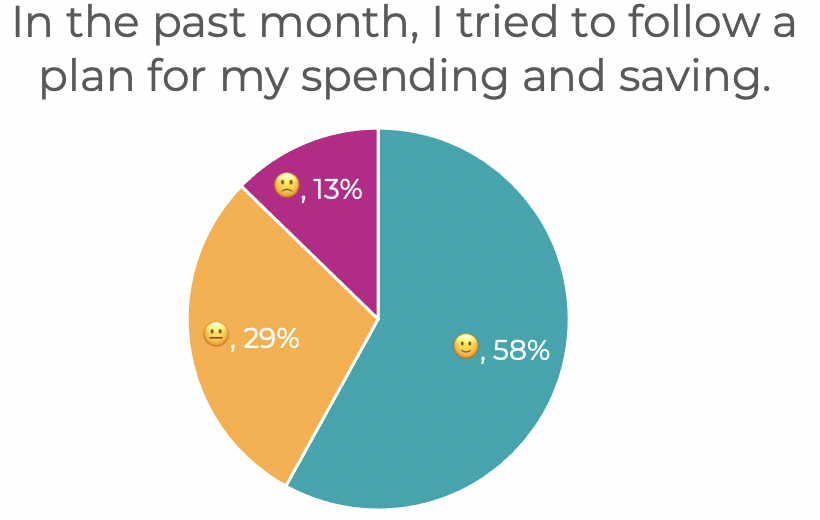

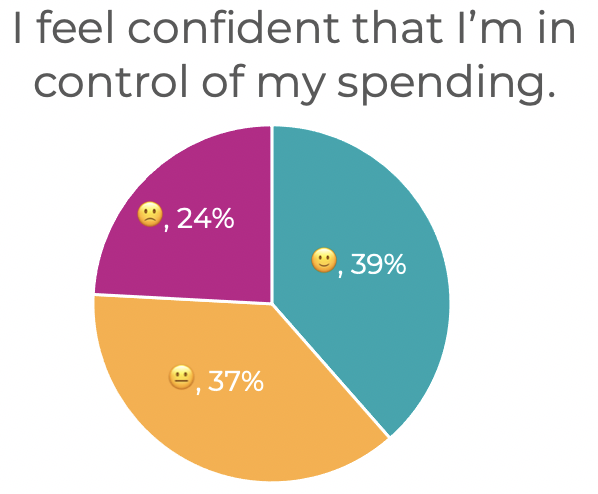

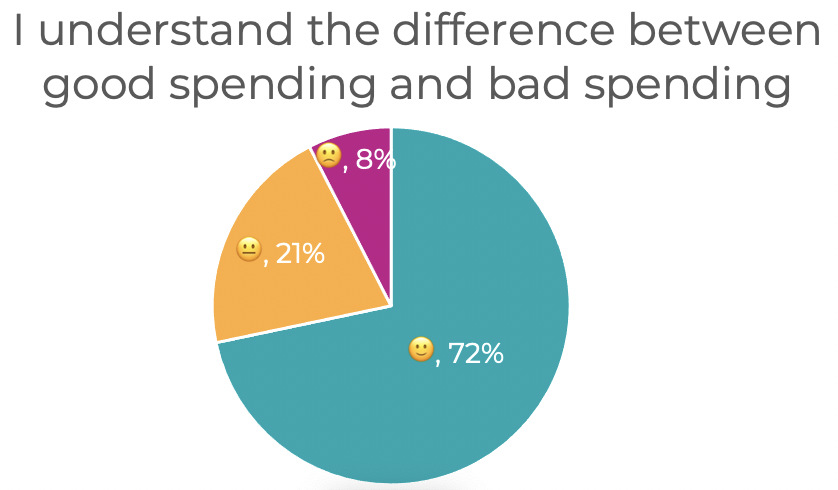

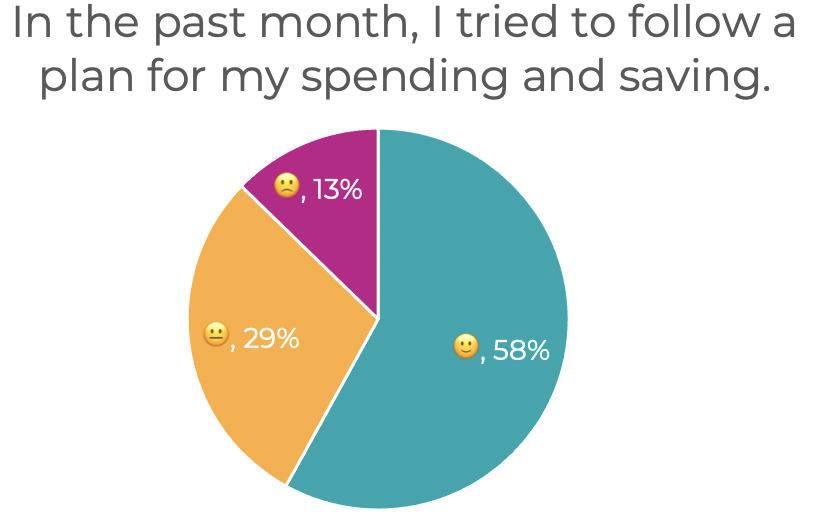

How SaverLife members feel about their spending.

Here are some resources to help your plan your spending:

- How to Manage What Gets Charged to a Credit Card

- What is Lifestyle Inflation?

- How to track and trim your subscription costs

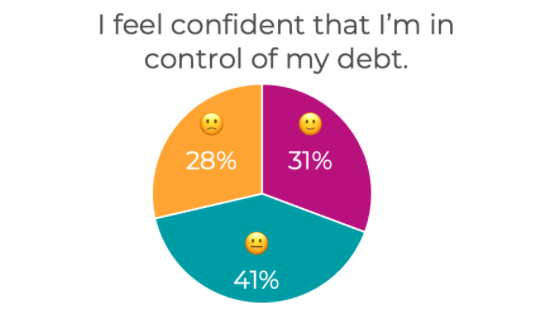

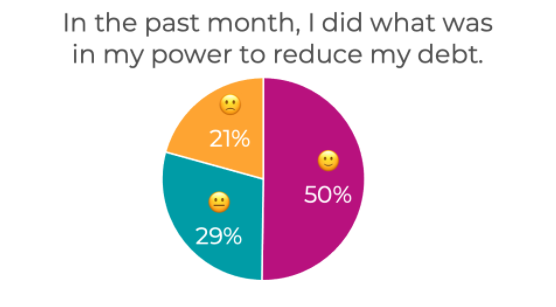

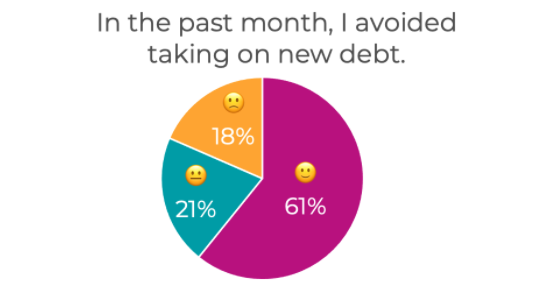

How SaverLife members feel about their debt.

Having debt can feel like you’re bearing a weight on your shoulders. Here’s some advice on how to lighten that load: